Prior Period Adjustments

Prior Period Adjustments are cost changes that couldn't be made to a receipt within a closed accounting period and therefore had to be created separately on the first day of the open accounting period.

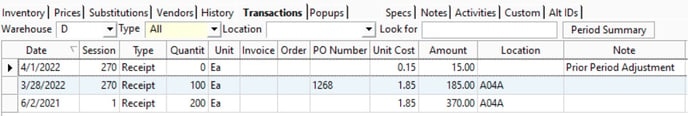

You might have noticed within a product's transaction history that there are some receipt transactions with a note contained the words "Prior Period Adjustment". The purpose of these "adjustments" is for Acctivate to add or subtract value from a receipt in the current accounting period when it was meant to be applied in a closed accounting period. In other words, if the posting of a purchasing invoice attempts to update the costs on the PO's receipt(s) but it can't due to the QuickBooks closing date, Acctivate instead makes these transactions in the open accounting period.

Where do Prior Period Adjustments come from?

Prior Period Adjustments are receipt transactions generated automatically by Acctivate when it first attempts to automatically update a receipt's cost but discovers the transaction was in a closed accounting period. Since transactions in this period can't be created, deleted, or otherwise modified, the only option for the software to make a separate transaction in the open accounting period (after the QuickBooks closing date) for the difference it would have adjusted the receipt by. This automated process only happens in one scenario: posting an invoice for a purchase order.

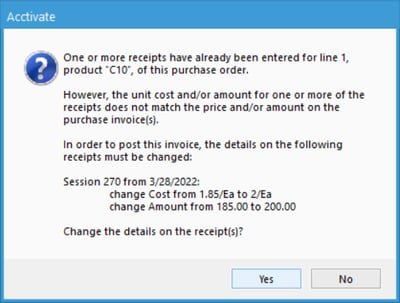

The reason this occurs is because, when you post a PO invoice, Acctivate first checks to see if the receipts that have already been posted for that PO have a unit cost that matches the invoice price for that PO line and product. If they're different, Acctivate will display a message explaining the situation and that the receipts will be changed to match the invoice. That's because the receipt is what dictates inventory value or cost and that cost is supposed to be what was paid during purchasing. Since there shouldn't be a difference between what was paid on the invoice and what the cost was on the receipt, Acctivate assumes the paid amount on the invoice is the correct value and updates any receipts to use that amount instead. In the instance when said receipt is on or before the closing date, a Prior Period Adjustment receipt is made for the difference on the first day of the open period.

Here's an example using the Acctivate Demo company:

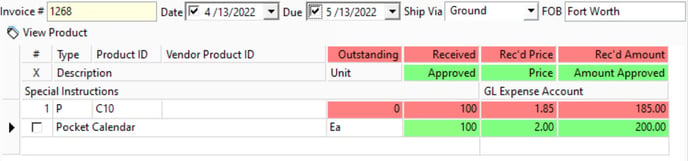

Let's say you made a new PO for 100 Ea of product C10 at the previous unit cost of $1.85 per unit. The total would be $185.00 on that PO which is what will load onto the receipt automatically. In fact, you do post that exact receipt on 3/28/2022.

Afterwards you run a sync to QuickBooks to send the new receipt journal. At some point in the future, the QuickBooks closing date is set to be 3/31/2022 and another QuickBooks sync is done in order for Acctivate to know what the new closed period is. This now means that the receipt posted earlier is in a closed accounting period and cannot be modified or deleted by either Acctivate or QuickBooks.

You then start to create an invoice for this PO with a date of 4/13/2022. However, after reviewing the invoice sent by the vendor, you realize the per-unit-cost of the product should have been $2.00 instead of $1.85 so it is changed to match the true invoice with a new total of $200.00.

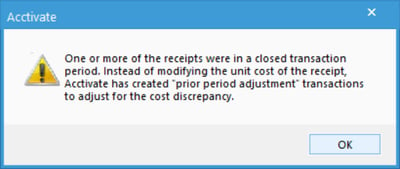

Attempting to post the invoice will then display a message saying that the receipt was found for a unit cost of $1.85 and that its unit cost will be changed to $2.00 so that it matches the invoice you are creating. Normally, this message is all you would see but, since the receipt in a closed accounting period, another message comes up stating that the adjustment for the discrepancy will be accounted for with a Prior Period Adjustment.

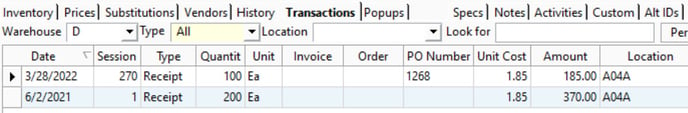

Now, if you look back at the inventory transaction history product C10, you will see a new Receipt transaction line on the first day of the open accounting period which is 4/1/2022. It doesn't adjust the receipt quantity but instead adds the $15.00 discrepancy between the $200.00 invoice and the $185.00 receipt. It also has a value in the Note column that says "Prior Period Adjustment".