Resolving the 'Please create in QuickBooks an Other Charge Item named "Purchase Tax Discrepancy", then synchronize again.' Sync Error.

'Could not determine which account to use when creating the Other Charge Item to be used for purchase tax rounding discrepancies. Please create in QuickBooks an Other Charge Item named "Purchase Tax Discrepancy", then synchronize again.'

In VAT editions of Acctivate (Acctivate integrated with the Canadian and UK editions of QuickBooks), Acctivate multiplies each purchase invoice line by it's tax code, then rounds the amount to two decimals. This is different than how QuickBooks calculates purchase tax, which is by multiplying the entire purchase invoice amount by the purchase tax code and then rounding the amount.

When a purchase invoice is synchronized to QuickBooks, the tax is recalculated using the QuickBooks method. If this recalculation results in a tax discrepancy, a synchronization error with instructions will occur:

Could not determine which account to use when creating the Other Charge Item to be used for purchase tax rounding discrepancies. Please create in QuickBooks an Other Charge Item named "Purchase Tax Discrepancy", then synchronize again.

As the error indicates, an Other Charge Item must be created in QuickBooks to handle the discrepancy. This item will be added to the purchase invoice with the discrepancy amount, resulting in the purchase invoice total matching Acctivate.

The following steps can be taken to set this up in QuickBooks:

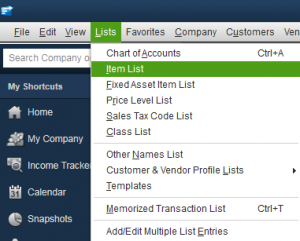

- Open QuickBooks and go to the Lists menu at the top of the screen, then click on “Item List”.

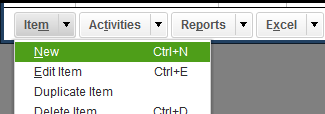

- In Item List window, click the Item drop down menu at the bottom of the window, then select “New” (or use the shortcut Ctrl + N)

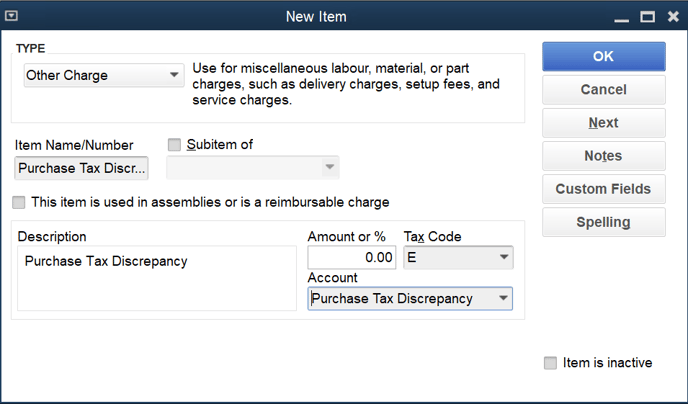

- A new window will appear, allowing you to enter the information about the new item.

- Select Other Charge as the Type

- Type Purchase Tax Discrepancy as the Item Name (it must match exactly). Optionally, you can enter any description.

- Leave the Amount or % as 0.00. Select a tax exempt tax code if you have one.

- Select an expense account such as “Purchase Tax Discrepancy” (the account name doesn't matter) as the account.

- Set the Once your new item looks like the screenshot below, click “OK” to create the item.

- CA and UK editions of QuickBooks have a vendor tax configuration option which, if enabled, will override the tax code of the Purchase Tax Discrepancy item. In QuickBooks, navigate to Edit > Preferences > Sales Tax. Click on the Company tab and uncheck the "Use Vendor Tax Code" checkbox.

- After creating the item Delete the bill from QuickBooks so that Acctivate can recreate it with the Purchase Tax Discrepancy item.

- Finally, run a sync with Acctivate. If you followed the steps above, the original sync error should no longer appear and the vendor bill in QuickBooks should match the Acctivate Purchase Invoice amount. However, your tax liability will only be based on the amount that QuickBooks calculated.