Setting up sales tax codes, groups and items.

An overview of how to set up your Sales Tax Codes, Groups, and Items

Acctivate synchronizes the Sales Tax configuration from QuickBooks. Sales Tax calculations are performed using the same method as QuickBooks. The following article is a brief introduction to the sales tax components in Acctivate. You should also refer to the QuickBooks Desktop documentation on Sales Tax here and here. For QuickBooks Online, please go here. For VAT tax in QuickBooks online, please see this QuickBooks help page.

There are three sales tax components in QuickBooks and Acctivate:

- Sales Tax Codes

- Sales Tax Items

- Sales Tax Groups (optional)

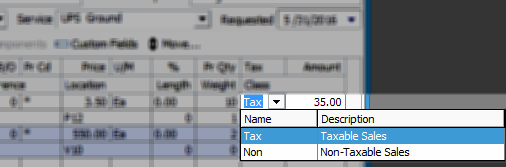

Sales Tax Codes are primarily used to distinguish between taxable and non-taxable (e.g., exempt) sales. The default Tax Codes are “TAX” and “NON”, but you can configure additional tax codes. The following examples were provided in a QuickBooks article above:

- TAX = Taxable Sales

- NON = Non-Taxable Sales

- OOS = Out of State

- LBR = Labor

- NPO = Non-Profit Organization

- GOV = Government

- WHL = Wholesalers

- RSL = Resellers

Tax Codes can be modified on each Sales Order Line. There is a default Tax Code at the bottom of the sales order. Changing the Sales Order Tax Code to a “Non” tax code will adjust all lines to the matching tax code.

Acctivate and QuickBooks both allow you to select a non-taxable code, but still record the tax district. The tax districts are represented by Sales Tax Items. Sales Tax Items contain the tax rates for each tax district.

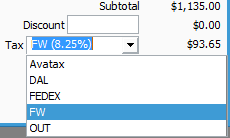

Many users will simply configure a single Sales Tax Item for each district. For example, a single “Fort Worth, Texas” Sales Tax Item would be configured at 8.25%.

The more appropriate method would be to create multiple Sales Tax Items for each tax district, then create a Sales Tax Group for “Fort Worth, Texas”. The Sales Tax Group would be selected on customer sales orders and invoices.

NOTE: The individual Sales Tax Items within the Group would NOT be visible for selection on Acctivate sales orders. You will need to create another Sales Tax Group for any individual Sales Tax Items that will also be used on sales orders.

For example, the 8.25% rate for the FW (Fort Worth, Texas) Sales Tax Group in our sample/demo company consists of the following Sales Tax Items:

- 1.00% FWCTY (City of Fort Worth)

- 0.50% FWMTA (Fort Worth Metro Transit Authority)

- 0.50% FWCR (Fort Worth Crime District)

- 6.25% TX (State of Texas)

Sales Tax Items and Groups are referred to as Sales Tax Locations (Tax Loc) on the Acctivate Sales Order.

The amount for each Sales Tax Item is calculated and rounded before calculating the total Sales Tax. Please refer to our Sales Tax discrepancies when using Sales Tax Groups article for more information.

NOTE: “Sales Tax Groups” are referred to as Sales Tax Categories in the CYMA edition.